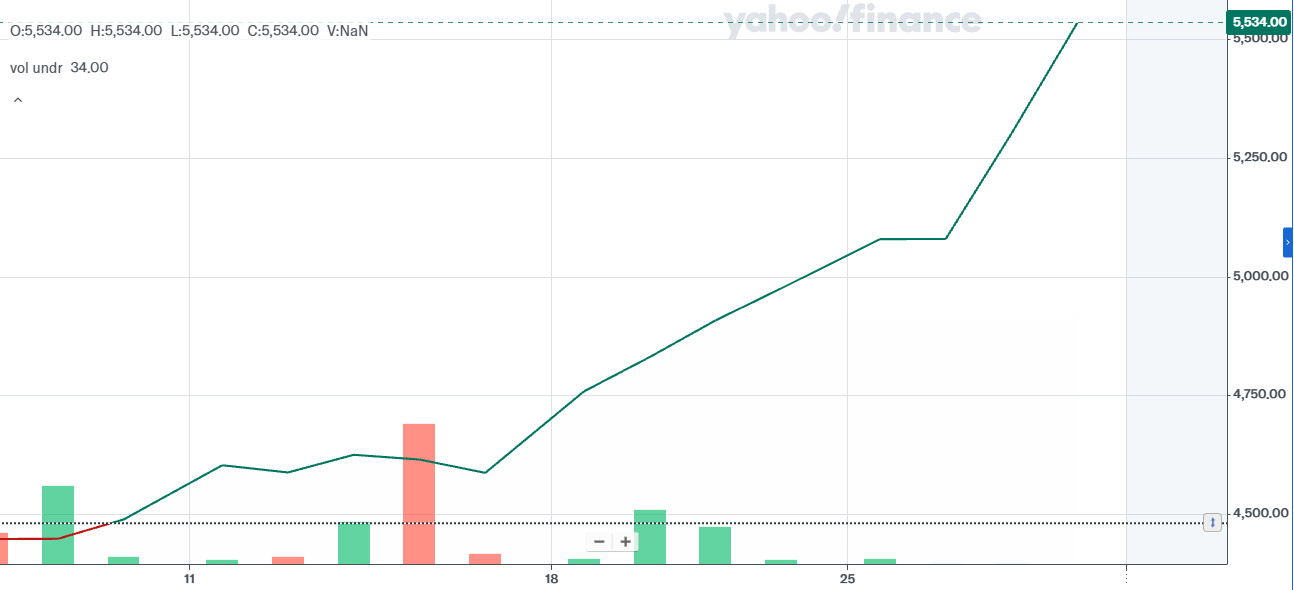

The gold price continues to run like on rails. After yesterday's new all-time high above $5,300, it marked the next all-time high at $5,626 on the morning after the Fed meeting (daily range ~$5,449–5,626). This means gold has already clearly exceeded almost all annual forecasts for 2026 – many analysts had expected an extreme case of $5,400–5,600 by the end of the year (e.g. Goldman Sachs $5,400, some even up to $6,000). The rally seems to know no brakes. The gold price is currently around $5,534.

What continues to drive the price?

After the Fed yesterday significantly reduced hopes of a quick further rate cut, at least a flattening of the rise would have been expected. What happened was the opposite and the rise is even steeper. So let's take a look at the possible reasons for this.

- Persistently weak dollar: The DXY is struggling at 96.26 and cannot gain ground despite solid US data. This makes gold more attractive to international buyers.

- Trump effect persists: The US President's statements (dollar criticism, tariff threats) have fueled uncertainty, leading to increased demand for safe-haven assets.

- Structural drivers: Central banks continue to buy gold aggressively, geopolitics (Middle East, Ukraine, Iran, Venezuela) remains tense, while real yields are developing negatively.

- Technical momentum: The break above $5,300 is likely to have drawn new buyers into the market, short squeezes are reinforcing the trend.

-

The gold price has largely ignored the Fed's interest rate decision and continues to rise! | Chart source: Yahoo Finance

Stock markets holding up – despite Fed hawkishness

The US indices initially reacted to the Fed meeting with declines (S&P 500 –0.8 to –1.2 % after the announcement), but are recovering somewhat in the morning (+0.1 to +0.4 % pre-market). The markets see the stable interest rate policy and dampened rate cut expectations as no real surprise anymore, but rather a confirmation of the robust US economy. Cyclicals and tech continue to benefit from the dollar weakness, while defensive sectors are falling behind a bit.

Oil and other commodities

WTI and Brent remain weak (–0.5 to –1 %). The US winter storm has not caused significant refinery shutdowns so far, inventories are high, demand subdued. The dollar weakness only helps oil to a limited extent – the downtrend continues.

Next possible triggers in sight

Today 14:30 CET: Initial and continuing claims for unemployment benefits are the main data today that could influence further monetary policy.

Tomorrow: Producer Price Index (PPI) data, which could provide further insights into inflation trends. A decline could give the gold price further momentum.

Conclusion

Gold largely ignores the Fed's hawkishness so far and continues to hunt records – the market is moving broadly: dollar weak, stocks stable to slightly positive, oil under pressure. The rally is currently driven primarily by momentum and sentiment, while structural drivers (central banks, geopolitics) form the basis. Anyone who wants to follow markets and prices live on PC or smartphone will find a neutral overview here of established platforms that cover almost the entire range of assets: To the Trading Platform Overview.