XTB Broker Review

XTB is one of the "veterans" of online trading on the global financial markets. The broker was founded in 2002 and is now one of the fifth largest listed CFD brokers in the world, with branches in 13 countries, including Germany, the United Kingdom and Spain.

Regulation of the XTB Broker

The broker XTB is headquartered in Warsaw, Poland. Accordingly, the company is authorised and regulated by the Polish Financial Supervision Authority in accordance with EU directives. XTB also has branches in 9 other EU countries where it is under the supervision of the respective financial supervisory authority, including BaFin in Germany, the FCA in the United Kingdom and the CNMV in Spain.

Instruments for Investment or Trading at XTB

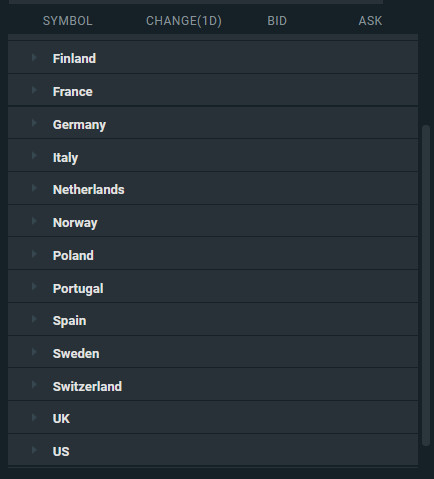

XTB's range of financial instruments clearly sets it apart from the majority of its competitors on the market. The broker XTB not only offers the option of trading CFDs. At XTB, investors can also invest directly in over 3,300 shares from 16 stock exchanges in Europe and the United States, even in fractional shares, as well as in more than 360 ETFs. This wide range of shares enables investors to build a carefully diversified portfolio to spread risk.

The Conditions for Stock Trading at XTB

The conditions for stock trading at XTB are among the most favourable on the market. The account management at XTB is free of charge (if the account is inactive for 365 days or more, a monthly fee of 10 euros is charged). XTB charges 0% commission on the purchase and sale of stocks for monthly transactions of up to 100,000 euros. A commission of 0.2% or at least 10 euros is charged for transactions above 100,000 euros. If a share is purchased in a currency other than the account currency, a surcharge of 0.5% is added to the exchange rate. If a financial transaction tax or stamp duty (UK) is payable on the purchase of a stock from a particular country, this will be deducted from the customer's account.

The minimum amount for investing in a stock is only 10 euros for stocks quoted in euros. This makes it possible to buy fractional stocks and invest in stocks with a high price in the portfolio. For all stocks that pay a dividend, this is credited to the customer's account.

The minimum amount for investing in stocks in the respective currencies is as follows:

- EUR: 10,00

- USD: 10.00

- GBP: 10.00

- DKK: 100.00

- NOK: 100.00

- PLN: 10.00

- SEK: 100

- CHF: 10.00

- CZK: 100.00

The Conditions for trading ETFs at XTB

XTB charges 0% commission for the purchase of ETFs, just like for real stocks. The minimum amount required to buy ETFs at XTB is almost unbeatable. With a minimum amount of just 1.00 euro, it is possible to buy smaller parts of ETFs that track different markets and thus diversify the risk.

Trading CFDs with XTB

XTB offers trading in CFDs on 6 different asset classes. In addition to CFDs on 71 currency pairs, 34 indices and 27 commodities, XTB also offers CFD trading on 1,900+ stocks, over 160 ETFs and 46 cryptocurrencies. With this offering, XTB covers most traders' preferred financial instruments.

The Conditions for trading CFDs with XTB

When buying and selling CFDs at XTB, the broker charges the current spread, i.e. the difference between the buy and sell price, when opening or closing a CFD position. If positions are held overnight into the next trading day (rollover), the so-called swap is incurred.

The swap can be positive or negative. A positive swap is credited to the customer's account, while a negative swap is debited. Customers can find the valid swaps for a financial instrument on the XTB website and in the individual list of financial instruments.

With regard to CFDs, traders must bear in mind that they involve a high risk of losing a part or all of the invested capital due to the leverage applied. They should therefore carefully weigh up whether to take the high risk of losing their capital.

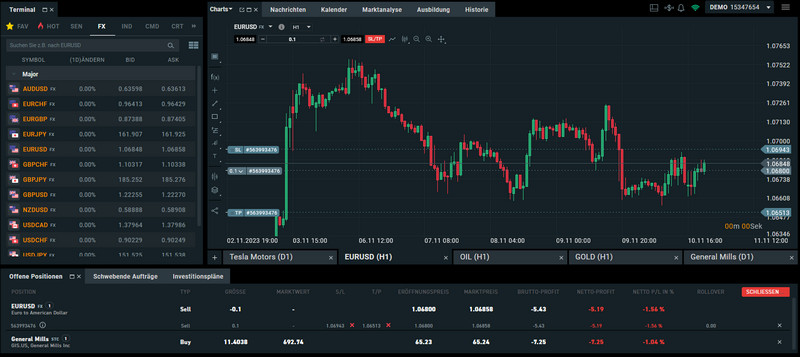

xStation - The Trading Platform at XTB

The broker XTB relies entirely on its proprietary trading platform xStation. This is available in a web trader version, as an application for desktop PCs and as a mobile xStation app for mobile devices with iOS or Android operating systems. The MT4 and MT5 platforms are not offered for trading, and there is a good reason for this. XTB has taken its proprietary xStation platform to the edge of perfection over the years.

The award-winning XTB xStation trading platform has a very clear and user-friendly interface. This makes the xStation platform ideal for both newcomers to financial trading and experienced investors and traders.

Features and Tools of the xStation Trading Platform

Introduction to the platform for beginners

For newcomers to the xStation platform or even to financial trading, it contains numerous video tutorials in which the basic aspects of the platform are explained in an understandable way. Here, XTB customers first learn which functions are called up where in the platform, how to find the desired instruments and everything else that is required for investment or trading transactions. There are also several hours of videos with market analysts and investment strategists.

The Charts of the xStation Trading Platform

Probably the most important tool for every investor and trader is the price chart. Describing the charts and the possibilities they offer in XTB's xStation platform as "impressive" is perhaps an understatement. At first glance, they do not differ significantly from those of other platforms. However, a closer look reveals that they are among the best available on the market. We would like to take a closer look at some of these features here.

Education for Beginners and Advanced Traders

The "Education" tab is located above the chart. It provides access to numerous training videos directly in the platform. These start with basic explanations of financial trading with the platform. There are also numerous videos with analyses of the market, live trading seasons, investment strategies and videos from the Academy. Beginners can seamlessly put the knowledge acquired here into practice with a demo account and thus potentially improve their financial trading skills.

Current News on the Assets on the Platform

The "News" tab contains the latest news on the assets available on the platform. These can be filtered by asset class so that investors and traders always have an overview of news on assets relevant to their trading and investment objectives. If required, positions on the financial instrument relating to the news item can be opened directly from the news item, including stop loss and take profit levels.

Economic Data always under Control with xStation at XTB

Under the Calendar tab there is a very comprehensive economic calendar. This provides an overview of all important global economic data, with a preview of events up to the end of the coming week. The information shown in the economic calendar can be filtered according to the countries in which they take place and the strength of the potential impact on the assets concerned. This ensures that investors and traders at XTB on the xStation platform can keep an eye only on the economic events that are relevant to them.

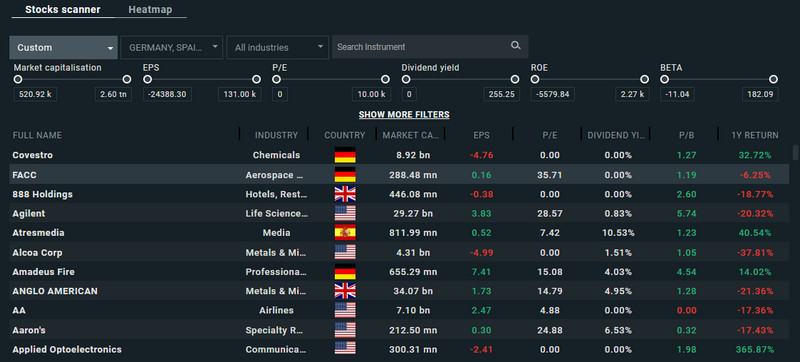

Markets analysed directly in the xStation Trading Platform

Under the "Market analysis" tab, investors and traders at XTB will find a stock scanner and a Heatmap for stocks from the EU and the USA as well as for currencies on the xStation platform. Even if these features are aimed more at investors and traders with a little experience, they are a real enrichment for the activity on the financial markets.

Customer Service and Support at the Broker XTB

When entering the financial markets, many investors and traders tend to give little thought to the quality of customer service at their chosen broker. This can mean that contact with them, especially when it is really needed, is very sobering. The broker XTB, on the other hand, shows that contact with customer service can actually be a pleasure.

Experience at XTB has shown that the response time from customer service and support is surprisingly short. The employees are consistently friendly, respectful and absolutely competent. They always take the time required to deal with the request. They never give the impression that a request is not being taken seriously. The number of languages in which customer service is available is also remarkable. XTB customers can reach customer service and support via email, live chat and telephone, in many countries with a national telephone number.

Payment Methods for Deposits and Withdrawals at XTB

The payment methods available at XTB are the "classics", which are usually absolutely sufficient for a serious investor or trader. In detail, these are

- Bank transfer

- Card payment with MasterCard, Visa and Maestro

- PayPal

- SOFORT

Deposits can be made in euros and US dollars. XTB does not charge any fees for all payment methods. In the case of bank transfers, however, it should be noted that the depositor's bank may charge fees for the transfer. If the currency deposited differs from the currency of the trading account at XTB, any conversion fees incurred must be covered by the depositor.

Conclusion on the Online Broker XTB

It is no exaggeration to say that XTB is an online broker that leaves little to be desired for investors and traders. The number of financial instruments available is huge, the conditions are more than competitive and the 0% commission for trading real stocks and ETFs makes stock trading and investing with XTB affordable even with small capital. Added to this is a trading platform that has what it takes to define new standards in online trading. When looking for the right broker, a visit to XTM should definitely be part of your search.

Go to the XTB Website now

Your capital is at risk

Advertisement