eToro Detailed Broker Review

eToro is an Online Broker that was founded in 2007 with the aim of revolutionising online trading for retail traders and investors. Over the years, the team has created a multi-asset platform that can be described as unique in its own way. It enables trading with underlying assets from 6 asset classes with the option of investing directly in stocks and cryptocurrencies. What makes eToro's platform so special, however, are its social trading functions. This is not just about simply copying the trades of other traders. It is also like a social network that facilitates the exchange of knowledge and experience with more than 30 million users worldwide. Find out everything you need to know about eToro below.

The Regulation of eToro

The Regulation of an online broker is the most important point that investors and traders should pay attention to when choosing a broker. eToro serves its customers from the European Economic Area (EEA) via its branch in Cyprus, eToro (Europe) Ltd. The company is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) under licence no. 109/10 in accordance with the applicable European legal requirements. This includes, among other things, the legal protection of customer funds.

Deposit Protection at eToro

Various mechanisms are in place at eToro to protect customer funds. Firstly, client funds are held separately from company funds in segregated accounts. This means that eToro cannot access client funds to cover the company's liabilities. In addition, customer funds at eToro are protected by a deposit protection fund up to an amount of 20,000 euros. Thanks to state regulation and deposit protection measures, eToro can therefore be considered a safe and reliable broker.

A special feature that sets eToro apart from most of its competitors is the insurance of up to EUR 1 million or AUD for cash deposits and assets (excluding cryptos) included for customers of eToro (Europe) Ltd. and eToro AUS Capital Limited. To receive this protection, the client must be a Platinum, Platinum+ or Diamond member of the eToro Club.

Assets offered for Investing and Trading at eToro

Before we go into the aspect of social trading, let's take a look at the investment and trading opportunities offered by the broker.

At eToro, customers have the opportunity to invest in and trade up to 6 different asset classes. In addition to stocks and ETFs, these include CFDs on commodities such as oil and gas, metals such as gold and silver, global indices and forex. In detail, the offering is as follows:

- 3424 Stocks

- 421 ETFs

- 32 Commodities

- 21 Indices

- 51 Currency Pairs

- 80 Cryptocurrencies

Trading and Investing in Stocks with eToro

At eToro, investors have the option of buying stocks directly. Directly bought stocks are positions on stocks that are opened without leverage. The stocks are purchased by eToro and held in custody on behalf of the customer. Accordingly, the customer is the owner of the purchased stocks.

0% Commission when buying Stocks on eToro

A special feature of stock trading at eToro is that investors have to pay exactly 0% commission to the broker for non-leveraged purchases of stocks. When buying stocks, only the market spread between the bid and ask price applies. However, further fees may be incurred. These can be found below in the summary of trading costs at eToro.

Buying Fractional Shares on eToro

Another special feature that not all brokers offer is the option to buy fractional stocks. The minimum investment in stocks at eToro is 10 euros. This means that customers invest, for example, 50 euros in a stock with a price of 100 euros. In this case, the customer would own 50% of the stock. This is made possible by the fact that the purchase of parts of a particular stock by several customers essentially creates a "community of owners" for an entire stock. If the whole stock cannot be bought together with other purchases, eToro acquires the remainder of the whole stock. If a customer buys further partial shares of this stock and ultimately owns a whole share, he leaves this community and is the sole owner of this stock.

What are the Advantages of buying Fractional Shares with eToro?

An important advantage of fractional shares is that they can be used to build up a diversified portfolio with less complex financial instruments, even with low initial capital. Diversification of the portfolio as an important protection against market risks, i.e. investing in stocks from different sectors, is something that everyone learns about quite early on when they start investing. With a minimum investment of just EUR 10, for example, EUR 100 can be used to buy five stocks from different sectors at an average price per stock/fractional-stock of EUR 20. In doing so, the customer receives the same benefits, e.g. potential dividends, and risks (market risk) as the owner of a whole stock in proportion to their participation.

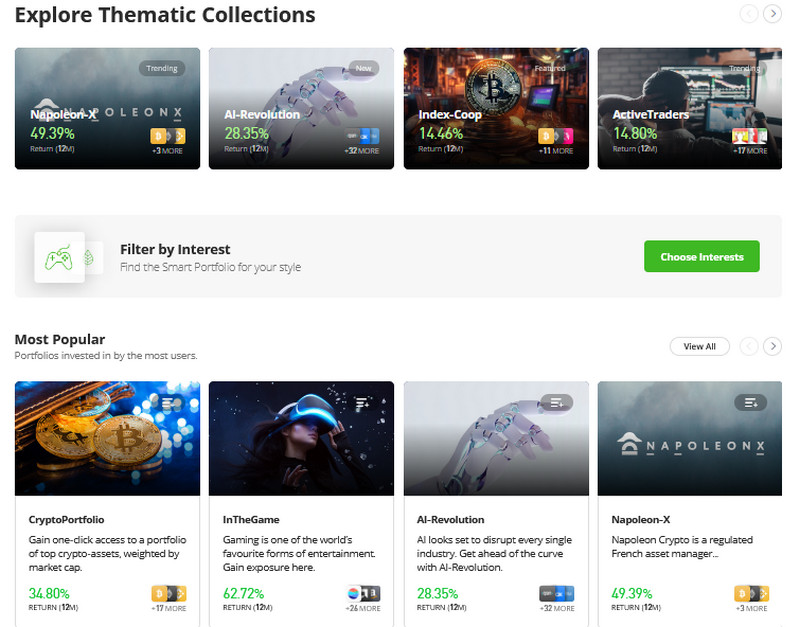

Smart Portfolios - Ready-made Portfolios at eToro

If you want to invest in stocks but don't have the knowledge or don't want to invest the time to build a balanced, diversified portfolio, you can take a look at eToro's Smart Portfolios. These are portfolios, each of which pursues its own investment strategy. The Smart Portfolios are compiled by investment experts at eToro, top traders and partners. There are currently around 90 different Smart Portfolios on eToro, which can be selected from 12 sectors.

The Trading Platform and Social Trading at eToro

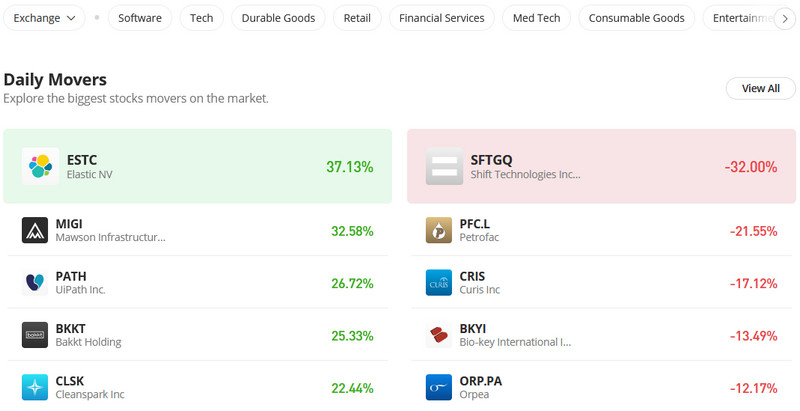

The trading platform at eToro is either web-based in the browser or available as a mobile app for smartphones or tablets with Android or iOS operating systems. Anyone accessing the platform for the first time will quickly realise that it is not just a simple platform. Rather, it is a complete portal that, in addition to the functions required for trading and investing, also provides a wealth of information that is important for traders and investors.

The most important area for active traders and investors can be found in the side menu under "Discover". This menu item provides access to all assets offered by eToro. These can be called up clearly by asset class and also filtered separately depending on the asset class. For example, stocks on eToro can be filtered according to around 20 different sectors and the stock exchange on which they are listed. (Note: the selected stock exchange is not the venue where transactions are executed on eToro).

Using a Demo Account on eToro

It is particularly important for those new to eToro that customers receive a free demo account in addition to the real account when they register with the broker. The eToro demo account has the same functions and contains the same assets as the real account and is equipped with a virtual balance of USD 100,000. In this way, traders and investors can test the platform with all its functions and their own financial trading skills completely risk-free before deciding whether they want to invest their own money.

Try a Demo Account at eToro

Your Capital is atrisk

Trading CFDs with eToro

eToro also offers trading in CFDs on underlying assets from all asset classes offered by the broker. In total, well over 3,000 underlying assets are available for CFD trading. Leveraged trading with CFDs is generally associated with high risks due to the complexity of the financial instrument. However, similar to options, it is sometimes also used to hedge an investment position in a bear market, for example.

76% of retail investor accounts lose money when trading CFD’s with this provider. You should consider whether you can afford to take the high risk of losing your money.

Social Trading and CopyTrader - An Outstanding Feature at eToro

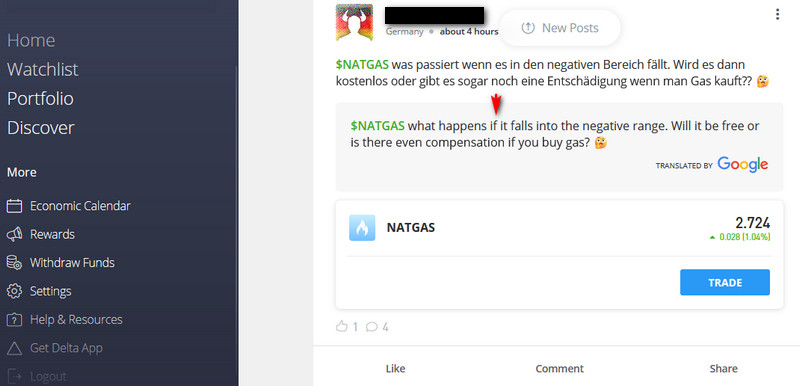

Social Trading is one of the features that have made eToro one of the most popular online brokers. It not only offers a simple selection of traders and investors whose trades can be copied. Even though it is not one, it is like a social network. This becomes apparent on the starting page of the eToro platform. Here you will find the news feed directly below the account overview. This feed contains contributions from eToro users from all over the world on their assessments of the various markets. As these naturally also appear in many languages, eToro has integrated a translation function. This allows users to read all posts and use the reply function to interact with each other and share their opinions on the relevant markets.

Find and Copy successful traders on eToro

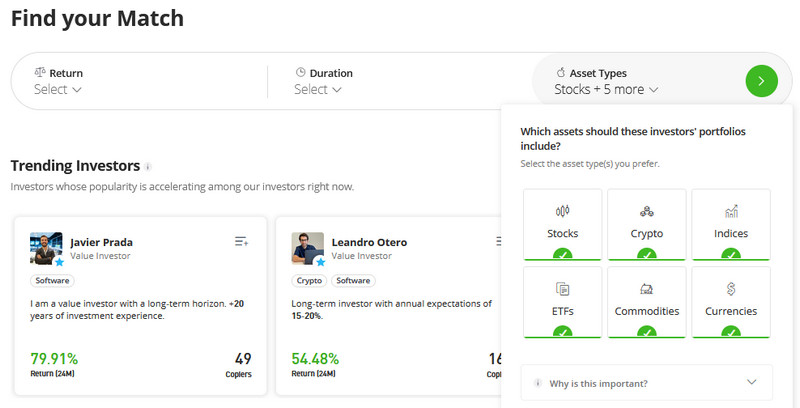

If you don't have the time or simply don't want to go to the time-consuming effort of researching the most suitable assets for your investment, you can also copy successful traders and investors via CopyTrading on eToro. There are many ways to find the right investor whose investment strategy and portfolio meet your own requirements. One approach is the news feed, in which users regularly report on the development of their portfolios, or you can take a look at the three currently successful investors presented on the starting page of the account.

However, for more in-depth information about all the traders to be copied, the "Discover >> CopyTrader" section is the right place to go. Here, the individual investors can be filtered relatively precisely according to your own requirements. This concerns the desired risk of the investment from low to medium to high. The duration, how long the selected position should be held and, of course, the asset classes that should be represented in the selected investor's portfolio. In addition, there is a ready-made selection of investors whose portfolios have outperformed the market in which they are invested.

Let your own portfolio be copied and become a Popular Investor at eToro

Investors who are experienced and invest themselves can also offer their portfolio for copying. Successful investors have the opportunity to become participants in the Popular Investor programme. To become a Popular Investor at eToro, an investor/trader must fulfil the following conditions:

- Complete profile with biography and profile picture

- At least $1,000 of unrealised equity

- Trade for at least 2 months without receiving a risk rating of 8 or more

- Win at least one copier

If these requirements are met and the investor is accepted into the programme by eToro as a Popular Investor, they receive various benefits, including an annual 1.5 % commission on the assets managed by copying their trades. The remuneration is paid monthly.

Deposits and Withdrawals at eToro

eToro offers a wide range of payment methods for deposits and withdrawals. For withdrawals, however, it should be noted that, according to official regulations, withdrawals must first be made to the payment method with which a deposit was made. If a method is only available for deposits, the payout is usually made to a bank account that is held in the customer's name. The available payment methods are

- eToro Money

- Credit/debit card

- PayPal

- Neteller

- Skrill

- Rapid Transfer

- Klarna/Instant banking

- Bank transfer

Some of eToro's payment methods are subject to country-specific restrictions. For example, Skrill and Neteller are not available to customers in most EU countries. In Spain, France and some other countries, PayPal can only be used after the first deposit (e.g. with a credit/debit card).

Customer Service and Support at eToro

The quality of a broker's customer service is a factor that an investor or trader should be aware of before opening an account with them. If they have a serious problem with their trading account or a particular position, for example, it can be frustrating if the customer service turns out to be poor or even useless.

The first thing that can be said about customer service and support at eToro is that extensive options are offered for answering questions or solving problems. Firstly, there is the Help Center, which is basically a FAQ section. However, the eToro Help Center does not only cover general questions about the trading account. In the Help Center, eToro customers can find answers to questions ranging from account opening and troubleshooting on the platform to fees and prices and much more.

If a question cannot be answered in the Help Center, the customer can contact an eToro employee directly via the live chat. They are usually competent and have the patience required to help customers with complex problems. However, if it is clear that the problem is more complex, it is advisable to open an enquiry ticket in the help centre via the "Customer Service" link. This allows the enquiry to be forwarded directly to the right department and the problem to be described in a detailed manner. Experience shows that it is often not possible to do this in live chat in the way that would be necessary.

Final conclusion on the eToro Online Broker

The fact that eToro is one of the heavyweights among online brokers today is certainly partly due to its extensive range of services and tradable assets. What is really interesting for investors is share trading with 0% commission and, in particular, the option to trade fractional shares. This makes it possible to build up a diversified portfolio, which is important for risk management, even with small amounts of capital. Social trading at eToro with the CopyTrader function enables inexperienced traders and investors to participate in the experience of potentially successful investors. Experienced investors, in turn, can benefit from having their portfolio copied by other investors and receive a fee in return.

The eToro platform is clearly organised and can also be accessed on the move with the mobile app. It also offers a wide range of information on the markets and assets that can be helpful when trading. Overall, eToro is a broker whose offering and services can be favourable for both beginners and experienced investors and traders.

Visit the eToro Website now!

Your capital is at risk

Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFD assets. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money