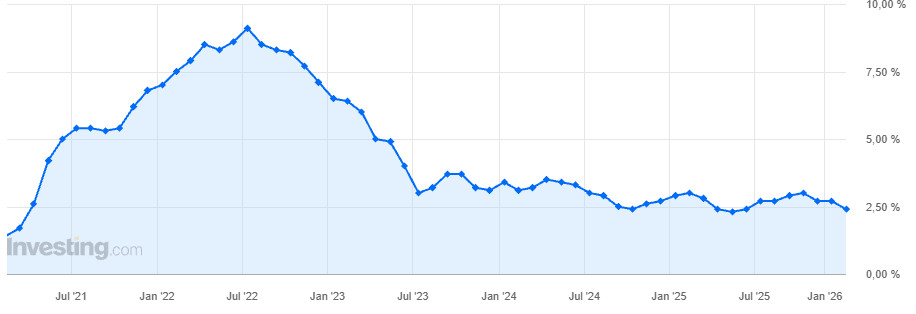

Today's US Consumer Price Index (CPI) came in slightly weaker than expected: Headline inflation +2.4 % y/y (forecast 2.5 %), m/m +0.2 % (forecast 0.3 %). Core CPI also slightly below estimates. At first glance, a clear dovish signal. Yet the market reaction is more than subdued: Indices barely moved, dollar only minimally weaker, gold and Bitcoin hardly give way. Why the CPI data seem to pass the markets without effect – and what could happen next.

CPI Figures in Detail – Slight Cooling, but Nothing Dramatic

The January CPI data show a further slight easing in consumer price increases:

- Headline CPI: +2.4 % y/y (expected 2.5 %)

- Headline m/m: +0.2 % (expected 0.3 %)

- Core CPI (ex food & energy): +3.3 % y/y (slightly below expectation)

- Core m/m: +0.2 % (also below forecast)

Especially core inflation is crucial for the Fed as it excludes volatile components. The decline is positive, but by no means dramatic enough to seriously question the Fed's „higher for longer“ stance. Shelter costs and services remain stubborn, keeping the Fed cautious.

Why the Markets Barely React

The reaction in the markets is surprisingly subdued despite dovish data:

- S&P 500 Futures +0.1 to +0.3 % (practically flat)

- Nasdaq Futures +0.2 to +0.4 % (slight recovery)

- 10-Year Yield -2 to -4 bp (only minimal decline)

- DXY -0.2 to -0.3 % (dollar barely gives way)

- Gold +0.4 to +0.6 % (slight bounce, remains below $5,000)

- Bitcoin +1 to +1.5 % (recovers somewhat, remains below $67,000)

There are several reasons for this seemingly indifferent reaction:

- Data was already largely priced in

Markets have been anticipating further inflation cooling for weeks. The January NFP beat was so strong that CPI figures are perceived more as confirmation of the trend – not as new, surprising information. - Fed remains „higher for longer“ dominant

Even at 2.4 % headline, core inflation remains above 3 %. The Fed has communicated very clearly in recent weeks that it does not react to a single good CPI print. Probability for March cut <10 %, June ~50–55 %. This is not enough for a real rally. - Technical factors and sentiment

Many indices are technically oversold after recent pullbacks → light short-covering buys, but no real risk-on impulse. Gold continues to fight the $5,000 mark as psychological resistance. Bitcoin suffers from the strong dollar and lack of new liquidity (ETF inflows moderate). - Waiting for next data & Fed

The market is already looking at PPI (tomorrow) and the Fed meeting next week. As long as Powell & Co. do not explicitly turn dovish, sentiment remains cautious.

Triggers for a Reversal – What Could Really Turn the Market?

In the current situation, a real trend reversal could only be triggered by several clear signals – and the next few days offer very little potential for that:

- No major data tomorrow (Saturday) – market closed or extremely thinly traded, practically no new impulses.

- Monday (Presidents' Day) – US exchanges fully closed. At the same time, China and many Asian markets are largely or completely out of operation due to Lunar New Year – partly the whole week. Until Tuesday/Wednesday, hardly any movement or new catalysts are to be expected.

- First realistic impulse: FOMC minutes on Wednesday – the minutes of the last Fed meeting could provide the first concrete indications of the central bank's current stance. Dovish tones (e.g. discussion of earlier rate cuts, concerns about growth or inflation cooling) would be a strong trigger for recovery in indices, gold and crypto.

- Technical bounce opportunities – As long as important supports hold (gold ~$4,900, Bitcoin ~$65,000, S&P 500 ~6,800 points), technical short-covering alone could cause a temporary bounce – even without fundamental news.

- Geopolitical easing or surprises – Positive news from crisis regions (Ukraine/Middle East) or unexpected stimulus measures from China (even if the market is currently closed there) could trigger risk-on.

In short: The market is currently in a real „wait-and-see mode“ with very limited catalyst density. The next realistic impulses are likely to come only from Wednesday with the FOMC minutes – until then volatility remains high, but direction unclear. Technical supports and geopolitical developments are currently the only potential drivers for short-term movement.

Conclusion

The CPI data are „good enough“ to keep recession fears at bay, but „not good enough“ to properly reignite rate cut fantasy. This is likely the most plausible explanation for the absent reaction. The market remains in „wait-and-see mode“ – until Fed signals or technical supports give clear direction. Anyone who wants to follow current prices live will find a neutral overview here of established platforms that cover almost the entire range of assets: To the Trading Platform Overview.