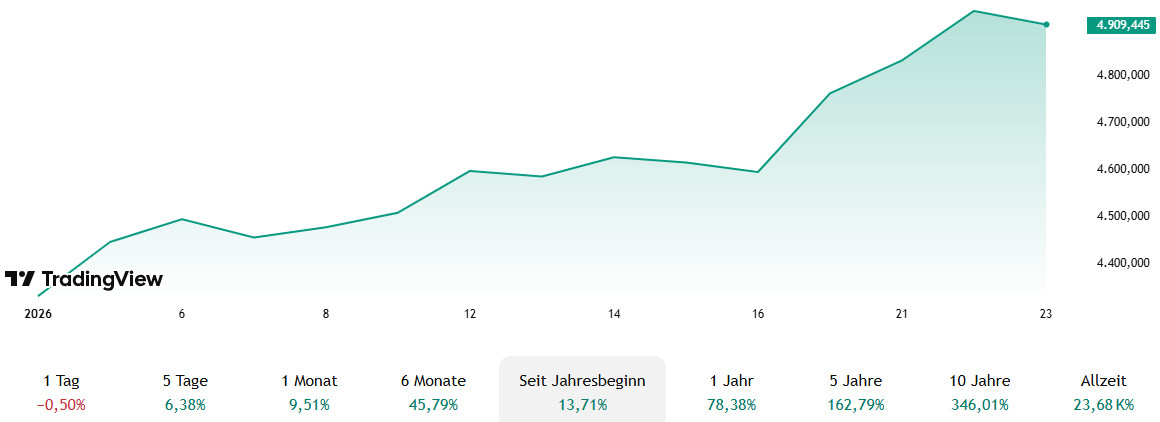

The gold price has seen an explosive rally since the beginning of 2026 and is rapidly approaching the psychologically important $5,000 mark. Starting from a closing price of $4,314.40 on January 2 (as January 1 was not a trading day), the price climbed to $4,961.10 by January 23, with an intraday high of $4,970. This represents a gain of about 15% in just three weeks – a pace that has electrified the market and made gold one of the top-performing commodities.

Experts from Goldman Sachs have raised their year-end target to $5,400, driven by a combination of geopolitical risks, economic uncertainty, and structural market factors. But what exactly is behind this rapid rise? Below is a breakdown of the development, its causes, and possible scenarios until the end of Q1.

The Price Development in Detail

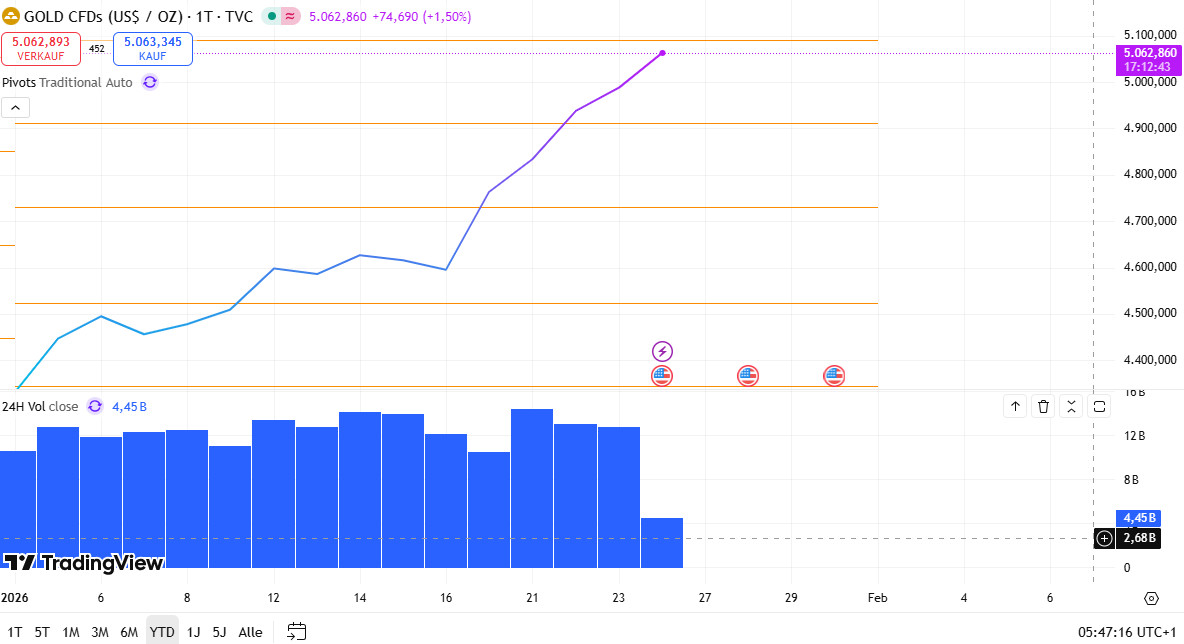

Historical data shows a clear upward spiral. The gold futures contract (GC=F) closed on January 2 at $4,314.40, with moderate volatility (high: $4,350.60, low: $4,314.40). By January 9, the price gradually rose to $4,490.30, fuelled by early January effects such as portfolio rebalancing. From the second week onward, the trend accelerated: January 16 closed at $4,588.40, and by January 20 it reached $4,759.60. The peak came in recent days – January 22 closed at $4,908.80, and as of January 23 (current) the price stands at $4,961.10 with a gain of +$47.70 (+0.97%). The day recorded a high of $4,970 and a low of $4,932.40, underscoring the ongoing volatility.

This development is part of a long-term bull market. Since the end of 2025, gold has gained over 20%, with January 2026 alone contributing a rise of around $647. Compared to other assets such as stocks or cryptocurrencies, gold shows low correlation, making it an ideal diversification option. Volume development is also revealing: while early January days saw volumes below 1,000, it jumped to over 63,000 on January 23, indicating rising investor interest.

Geopolitical Tensions as a Driver for Gold

Geopolitical uncertainties remain a key driver. The escalation of the US-EU trade dispute under President Trump, including new tariffs in the context of the Greenland dispute, has driven investors en masse to gold. Ongoing conflicts in the Middle East, the war in Ukraine, and tensions between Japan and China are intensifying the risk perception. Gold acts as a classic safe haven: in times of instability, demand rises because it stores value independently of currencies or stock markets. Analysts estimate that these factors alone account for $200–300 of the rise.

Monetary Policy and Economic Factors

Central bank policy is fueling the trend. The Federal Reserve has signaled interest rate cuts to support growth, lowering the opportunity cost of holding gold – an asset with no yield that becomes more attractive at low interest rates. A weaker US dollar, influenced by concerns about the US market, reinforces this: gold becomes cheaper for international buyers. Inflation fears, fueled by protectionist measures, make gold a hedge against inflation. In addition, central banks such as China and India are building up their reserves to reduce dollar dependency – net over 1,000 tons last year, continuing into 2026. Private investors are following suit, boosting ETF inflows.

Structural and Market-Specific Influences

Structural factors underpin the rise. Mining companies are struggling with high costs and regulations, limiting supply. Industrial demand is increasing, especially for electronics and jewelry in Asia, as well as indirectly through the Green Deal (solar panels, electric vehicles). The January effect – fresh capital inflows and rebalancing – reinforces the dynamic but can also lead to speculation and potential overextensions.

Possible Scenarios Until the End of Q1

By the end of March 2026, the gold price could move in two directions depending on economic and geopolitical developments.

Scenario 1: Bullish breakthrough above $5,000

If geopolitical risks continue to escalate or deeper rate cuts occur, the price could climb to $5,200–5,400, as predicted by Goldman Sachs. A weaker dollar and rising inflation would fuel this, with central bank purchases acting as a stabilizer.

Scenario 2: Correction and stabilization around $4,700

If the US economy stabilizes and interest rates rise, gold could come under pressure, falling back to $4,500–4,700. Reduced geopolitical tensions and a stronger dollar would dampen demand, leading to temporary consolidation.

In summary, gold remains a strong safe haven but also the price remains volatile. Investors should weigh risks carefully.

Advertisement