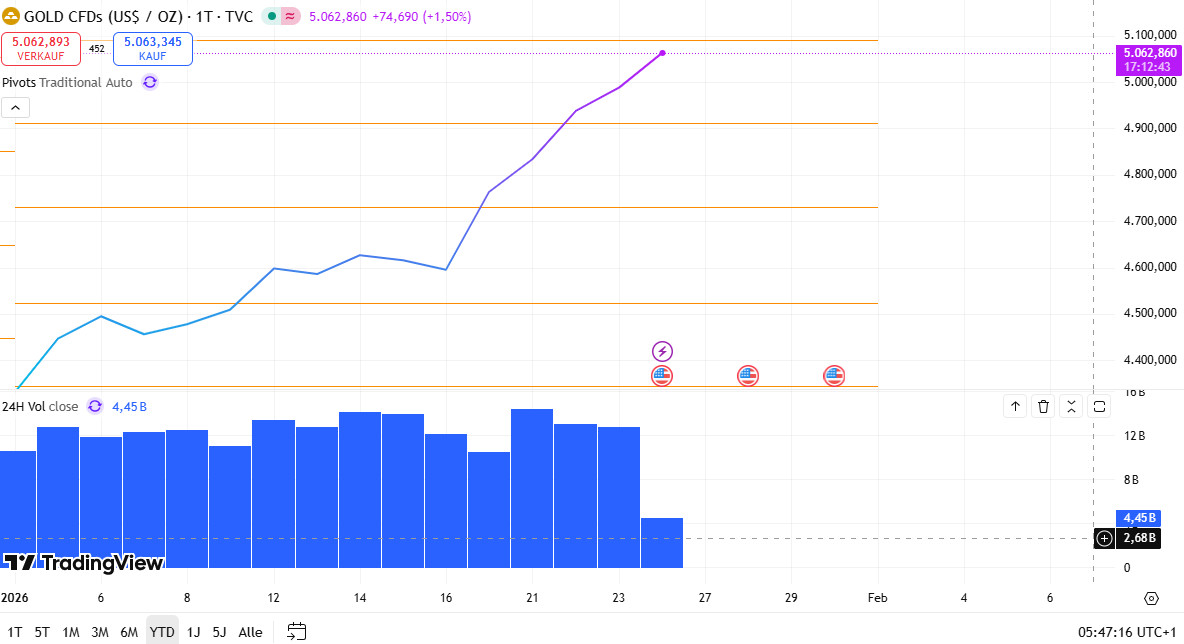

Gold has done it: For the first time in this cycle, the price has broken above $5,000 per ounce. As of Monday morning (January 26, 2026), spot gold is trading around $5,010–5,020, with futures slightly higher. A strong weekly start – but many are now asking: Is this the beginning of the end or will the bull market simply continue?

The Key Drivers Behind the Break

- Weak US Dollar: DXY below 103 – gold becomes cheaper for international buyers.

- Fed without hawkish signals: No more rate-hike talk, real yields remain negative.

- Geopolitical tensions: Middle East, Ukraine, Taiwan concerns – safe-haven demand stays elevated.

- Central bank buying: China, India and others continue to accumulate.

- January effect: Commodities often start the year strong – 2026 is no exception.

Outlook: Pause or Further Rise?

Short-term bullish: Many analysts see $5,200–5,400 as realistic if the dollar continues to weaken and risk aversion persists. Goldman Sachs has already raised its target to $5,400.

Medium-term correction possible: Profit-taking, a stronger dollar or sudden risk-on mood could push the price back to $4,800–4,900. The 5,000 level would then become a strong new support.

For long-term holders (physical or ETF): Stay relaxed – the big-picture trend is bullish. For traders: Watch 5,000 as a key level – a clear hourly close significantly below the mark could trigger quick liquidations.

Conclusion

The break above $5,000 is more than just a round number – it shows that the fundamental drivers for gold remain intact. Whether we now see a healthy pause or the run continues depends heavily on the dollar and global risk sentiment. One thing is clear: gold remains a hot topic in 2026.

Want to follow the gold price live or invest in ETFs? Here’s a neutral overview of popular and renowned trading platforms.