The gold price continues to hover just above the $5,000 mark today but has so far failed to benefit from weak US retail sales. The Dow Jones has marked a new all-time high (ATH), the S&P 500 is moving just below 7,000, while the Nasdaq cannot follow the trend. Bitcoin continues to fight around the $70,000 mark. Here is a current overview of market developments on Tuesday.

Gold Price: Weak Dollar Helps, Retail Sales Disappoint

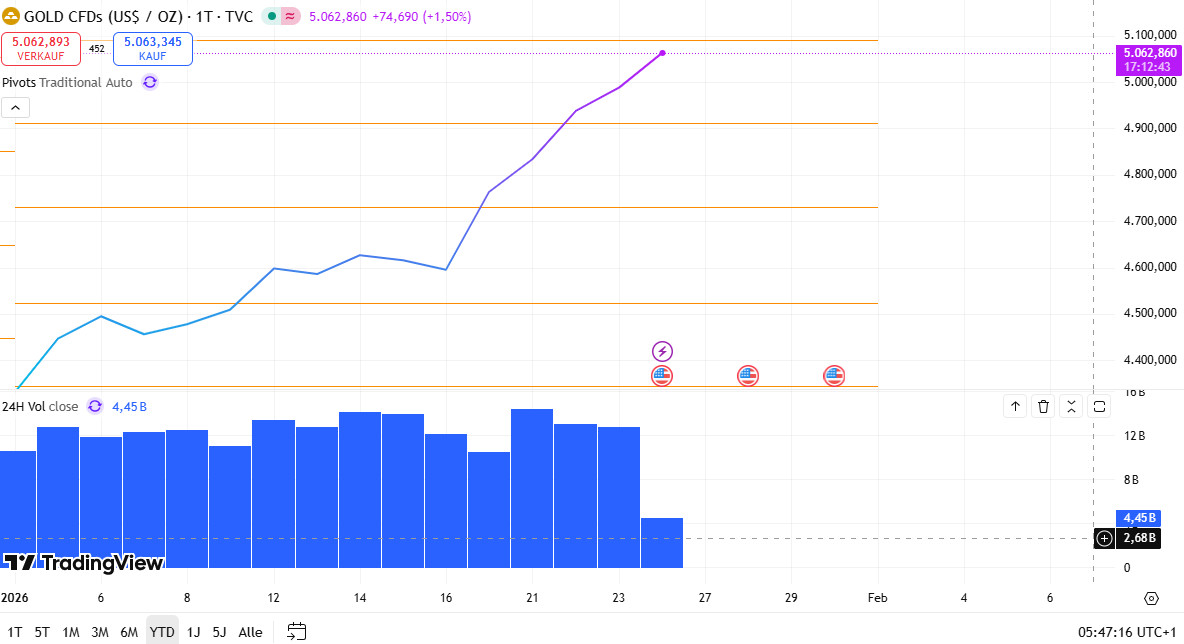

Gold is trading today at around $5,036 per ounce and is holding just above the psychologically important $5,000 mark. The weak US dollar (DXY at approx. 98.5, EUR/USD at 1.191) is supporting the price, as gold becomes more attractive as a dollar-denominated asset due to dollar weakness. However, gold has so far failed to benefit from the weak US retail sales: These stagnated in December at 0.0 % (expected +0.4 %, previous month +0.6 %). This indicates a cooling consumer demand, which would normally increase expectations of rate cuts and support the gold price. The market is now waiting for tomorrow's US labor market data (Non Farm Payrolls) and the CPI figures on Friday.

Indices: Dow at New ATH, S&P Just Below 7,000, Nasdaq Weak

The Dow Jones has marked a new all-time high at 50,512.79 points and is showing strength despite weak retail data. The S&P 500 is moving just below 7,000 at 6,977 points and remains stable at a high level. The Nasdaq, however, cannot follow the trend and is trading weaker (approx. -0.3 %). The mixed reaction indicates sector rotation: Tech weak, defensive (financials, energy) stronger. The markets are waiting for further US data to assess the further course of Fed monetary policy.

Bitcoin: Fight for the $70,000 Mark

Bitcoin is currently moving at $69,216 and continues to fight around the $70,000 mark, which has so far not been sustainably overcome. The price has fluctuated strongly in recent days, but is benefiting from risk appetite in the indices. Nevertheless, volatility remains high, and a break below $68,000 could trigger further sales. Like gold, Bitcoin is reacting to the weak dollar but is waiting for clear Fed signals.

Conclusion

The market is showing a mixed reaction today: Gold is holding thanks to a weak dollar, indices partly at ATH, Bitcoin in the range. Weak retail sales could favor rate cuts, but the next data (NFP, CPI) will be decisive. Anyone who wants to follow the prices live will find a neutral overview here of established platforms that cover almost the entire range of assets: To the Trading Platform Overview.