The gold price has gained new momentum with the break above the $5,000 mark. Many beginners are now asking themselves: Should one buy physical gold (bars, coins) or rather use gold ETFs or ETCs? Both options have their strengths and weaknesses – here is a direct comparison that takes the current market situation in 2026 into account.

Physical Gold (Bars and Coins)

Advantages

- One owns the real metal – no issuer or counterparty risk (no bank or ETF provider can go bankrupt).

- Long-term crisis-proof: In extreme scenarios (banking crisis, currency crash), one has something tangible in hand.

- No ongoing management fees (except for storage and insurance).

- No deviation from the spot price due to tracking error or spreads.

Disadvantages

- High purchase and sales premiums: 3–8 % depending on dealer and denomination.

- Storage & security cost money: Safe, bank safe deposit box or insurance (0.5–1.5 % p.a.).

- Poor liquidity: Selling takes longer and is often associated with a discount.

- No interest or dividend – pure tangible asset without yield.

- High effort: Purchase, transport, secure storage, later sale.

Gold ETFs / ETCs (exchange-traded products)

Advantages

- Very low costs: TER mostly 0.15–0.40 % per year (sometimes even below 0.2 %).

- High liquidity: Buy and sell like a share, in seconds during exchange opening hours.

- No own storage required – everything is in the depot.

- Monthly savings plan possible (from 25–50 €, often without order fees).

- High transparency: Daily price fixing, holdings visible, daily redemption possible.

Disadvantages

- No physical possession – in the event of issuer insolvency (very rare, but theoretically possible) there is residual risk.

- Small tracking error & spread can lead to minimal deviations from the spot price.

- Taxed in Germany like shares (capital gains tax, no speculation period).

- Dependence on exchange, depot bank and issuer.

Which option suits beginners in 2026?

For most beginners, **gold ETFs/ETCs are probably significantly better suited** than physical gold:

- Low costs and easy handling outweigh the advantages of physical ownership.

- In savings plans (monthly 50–200 €), physical gold is impractical (minimum sizes, high premiums).

- Physical gold only pays off from larger amounts (from approx. 10,000–20,000 €) and if one is explicitly looking for a „crisis bunker“.

Possible beginner combination 2026: 70–90 % gold ETF/ETC (e.g. Xetra-Gold, EUWAX Gold II, iShares Physical Gold ETC, WisdomTree Physical Gold) + 10–30 % physical (small bars or Krugerrand coins as backup).

Conclusion

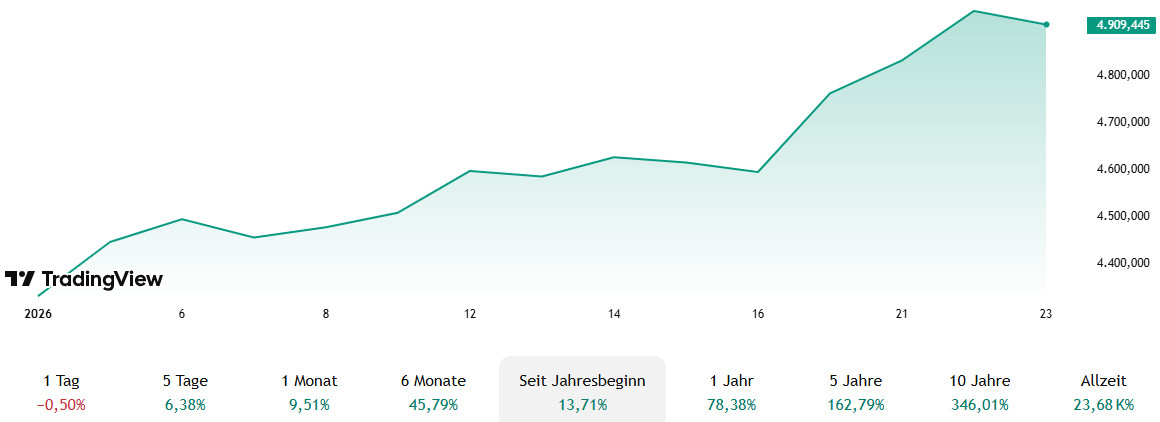

Gold remains an exciting component of any portfolio in 2026 – for beginners, ETFs/ETCs are usually the more practical, cost-effective and flexible solution. Anyone who wants to buy physical gold should see it as a supplement, not as the main component. Anyone who wants to follow the development live or invest in gold ETFs will find a neutral overview here of common platforms that cover almost the entire range of assets: To the Trading Platform Overview.